As we celebrate America’s birthday this month, it’s a fitting time to declare your own financial independence. Securing your financial freedom helps you build a brighter future, and getting started is easier than you might think. Here are some simple steps to take this summer and in the year ahead:

Create a simple plan

Key word: simple. Don’t get overwhelmed by setting too many goals — focus on the big ones that matter to you, such as saving for a down payment on a new home or starting a rainy-day fund.

Set monthly and yearly goals and break them into “micro” steps. Then, check in regularly to track your progress. The best plans are customized and flexible, changing along with your life’s circumstances.

Pay yourself first

More than 1 in 5 working American adults aren’t saving for the future, according to a Bankrate.com survey. The No. 1 reason why? Expenses.

When you put your bills front and center, you might feel that you can’t save at all. Instead, try paying yourself first — putting aside part of every paycheck, even if it’s just $5. If you set up auto deposit, you won’t notice the difference.

By treating your goals as a top priority, you’ll see your savings grow steadily over time. Whether it’s saving for a wedding or buying a new car in cash, you’ll appreciate yourself for planning ahead.

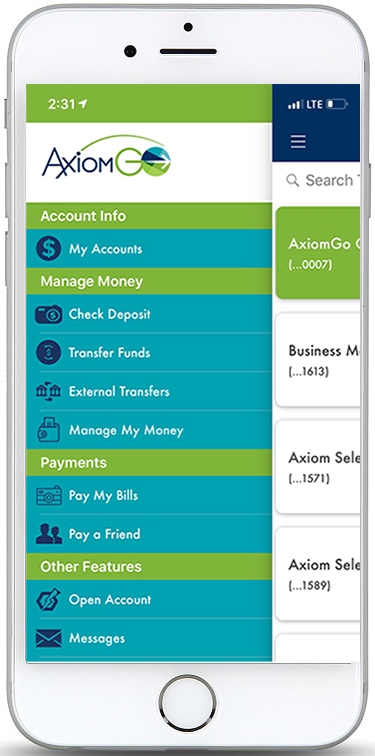

Take advantage of tech

Research shows that if you want to start and stick with a habit, like budgeting, you need to follow an easy path. The fewer barriers in your way, the likelier you are to stay on course. Mobile banking apps like AxiomGo put all the power in your pocket. AxiomGo’s integrated budgeting tool allows you to categorize spending, track your habits and pinpoint ways to cut back.

Trust the process

Whether you’re starting financial habits or a fitness routine, lifestyle changes take time and patience. You might not see immediate results — but stay committed, and you’ll notice changes over time. Keep a long-term vision in mind, and you might be surprised by your progress.

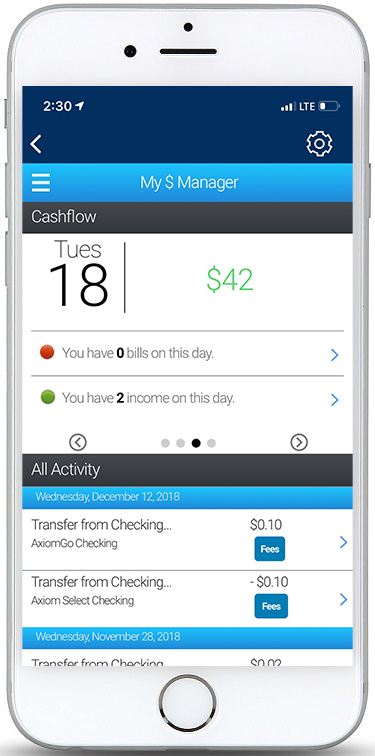

Celebrate the wins

Positive reinforcement activates the “reward” center in your brain, cementing good habits for the long run. With AxiomGO’s My $ Manager budgeting tool, you get notified whenever you hit a milestone. Taking a moment to recognize those wins helps you stay motivated toward your goals.

Bringing it all together

Financial independence means less worry and more freedom to enjoy life, but you need a blueprint to get there. Whether you’re just starting out with budgeting and saving, or well down the road, getting a handle on your money is an achievement worth celebrating. So start up the barbecue, settle in for the fireworks — and make this summer one for the history books.

Axiom Bank, N.A., a nationally chartered community bank headquartered in Central Florida, provides retail banking services, including checking, savings, money market and CD accounts, as well as commercial banking, treasury management services and commercial loans for both real estate and business purposes.

Comments