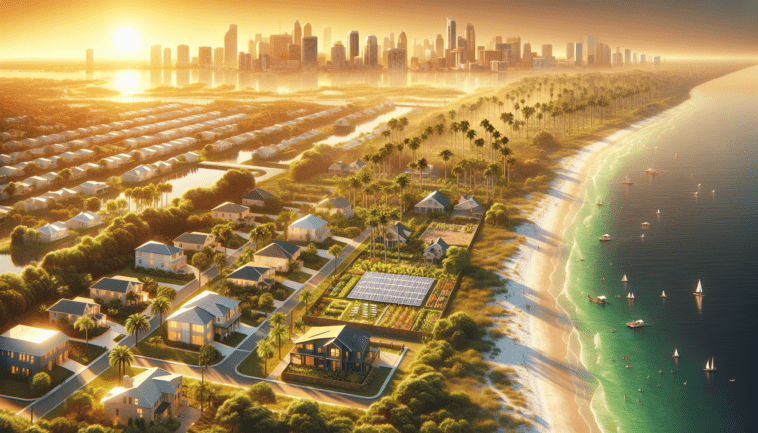

Living in Central Florida offers a unique blend of opportunities and challenges when it comes to managing our finances. The region’s vibrant economy, coupled with its renowned attractions, presents a dynamic environment for both personal and financial growth. Whether you’re taking in the scenic beauty, enjoying the bustling city life, or prepping for the unpredictable weather, smart financial planning is key. While investing in your home, it’s also crucial to consider finding the best pet insurance Florida has to offer, ensuring that your furry friends are covered in a state known for its wild weather. Let’s dive into how you can make the most of living in this beautiful area while ensuring you’re on solid financial ground.

Smart planning for a sun-kissed lifestyle

The first step to financial wellness in Central Florida is understanding your goals. Whether it’s saving for a beach house, investing in a local business or simply ensuring you can enjoy everything the region has to offer, setting clear objectives is crucial. With Florida’s hurricane season to consider, an emergency fund isn’t just advisable; it’s essential. Diving into the local investment scene, such as the real estate market or tourism sector, can also offer rewarding opportunities. Meanwhile, tapping into local advice can provide tailored strategies to navigate the unique financial landscape of Central Florida.

Embracing the sun-kissed lifestyle of Central Florida means not only planning for today but also for the future. Considering retirement plans and investment opportunities unique to the area, such as solar energy initiatives, can harness the power of the sun for long-term gains. Furthermore, exploring local educational resources, like financial management workshops and seminars, can empower residents with the knowledge to make informed decisions that are in harmony with the region’s economic climate and personal aspirations.

Home is where the heart (and investments) is

For many, homeownership is a quintessential part of the Central Florida dream. Navigating the mortgage waters can be tricky, but with the right planning, it’s possible to secure a home that not only fits your lifestyle but also serves as a wise investment. Regular maintenance and timely improvements are critical for preserving your home’s value, especially in a state known for its tempestuous weather. Speaking of weather, don’t forget to reassess your home insurance annually, ensuring you’re covered for everything from hurricanes to flooding.

If you’re diving into the housing market, consider the benefits of working with local real estate professionals who understand the nuances of Central Florida’s neighborhoods. They can offer insights on upcoming developments and community initiatives that might affect property values. In addition, taking advantage of state-sponsored homeowner programs could lead to significant savings, making the dream of owning a slice of paradise more attainable and financially wise.

Living it up without breaking the bank

Central Florida’s allure isn’t just its sunny beaches and palm trees; the array of entertainment options is truly unparalleled. That said, the cost of fun in this theme park capital can quickly add up. Budgeting for leisure means finding a balance between thrill-seeking and savvy spending. Don’t overlook the myriad of discounts available for Florida residents or the benefits of off-peak travel. Additionally, preparing your finances for hurricane season can prevent a weather emergency from morphing into a financial crisis.

Discovering affordable fun in your backyard

Beyond the theme parks and tourist hotspots, Central Florida is thriving with affordable, even free, entertainment options. From the tranquility of local parks to the rich cultural tapestry offered by museums (often at a discount), there’s no shortage of low-cost ways to enrich your life. Community sports, recreational leagues, and public pools offer not just exercise but a chance to connect with neighbors, blending fun with community building.

Squeezing every penny: Smart savings tips for locals

Day-to-day expenses can quickly spiral if not kept in check, more so in a bustling region like Central Florida. Groceries, dining out, and even your daily cup of Joe can eat into your budget. Leveraging local farmer’s markets and special dining deals can keep both your belly and wallet full. When it comes to getting around, consider carpooling, public transit, or even biking to save on gas and parking. Finally, don’t forget about your furry friends. Ensuring they’re covered with the best pet insurance Florida residents can get is not just a safety net for them but also a financial safeguard for you.

In summary, thriving in Central Florida is all about balancing your financial health with the endless opportunities for enjoyment the region offers. Smart financial planning, informed investing, and mindful spending can make life in the Sunshine State as blissful as it sounds. So, here’s to making the most of living in this vibrant, dynamic corner of the world, equipped with the knowledge and strategies to keep our finances flourishing.

Comments